Establishing a profitable commercial property management firm is an exciting opportunity, regardless of how many properties you now own or if you just want to go solo (from your current real estate company). Not simply because of the money, but also because managing a variety of individuals and properties—landlords, contractors, tenants, etc.—is an advantage.

To be completely compliant, you must have a thorough understanding of the local real estate and landlord-tenant regulations, which means there is a learning curve associated with this position.

If you believe you are qualified, see the complete guide below.

Law Firm and Permits

Prior to investing large sums of money in different commercial buildings, you need to be sure your company has a suitable legal structure. Your personal and business assets are currently linked, and the court views them as one cohesive entity. That means your personal assets (house, car, etc.) could be seized to satisfy the debt if your company ever loses a court settlement.

Remember to obtain the necessary business or real estate licenses, as well as any broker’s license, if your state or nation demands them. Ignorance of the law is not an excuse, so be sure you are aware of and abide by all the various guidelines.

Create an Official Business Plan

There are two reasons why you can start creating a proper company strategy now that the legal wrangling is over.

Initially, you should try to get outside finance in the form of venture capitalists and investors. Once more, the structure of your company will be crucial in this. For instance, a C-corporation can have an infinite number of shareholders, but an S-corporation can only have 100. This makes it much more important for you to provide your investors with a good “treasure map.”

Secondly, you should make one for yourself to utilize as a kind of business road map that will provide you with guidance and propel you forward.

Thus, take a seat and draft a thorough business plan that outlines your goals for the next five years, including how you will use investment funds, anticipated earnings, workforce requirements, etc.

Make the Correct Technology Invest

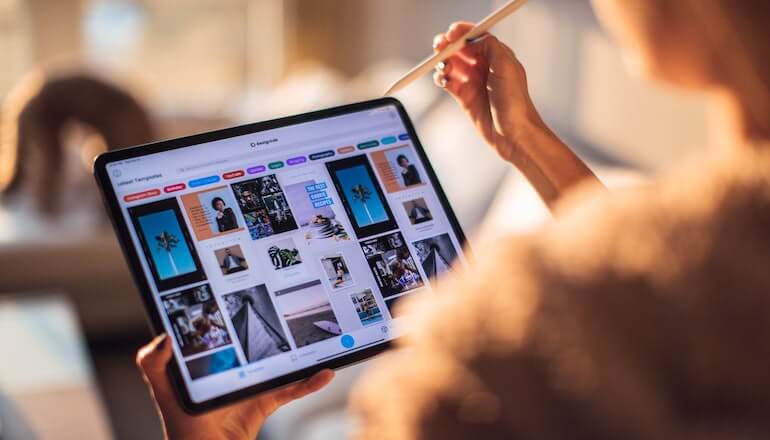

The condition of technology is always evolving. Therefore, in order for a brand to remain competitive in the twenty-first century, it is imperative that they keep up with the most recent technology advances. However, those who do take use of these new technology developments will have an advantage over their rivals.

For example, Australia’s top real estate software company Rockend created Property Tree, the newest in cutting-edge property management software, which gives you limitless, round-the-clock cloud access to manage properties even when you’re on the move. Additionally, it has an intelligent invoicing and receiving system of its own that streamlines and automates the entire payment process for your business properties, resulting in quick and simple rent collection.

All things considered, investing in the appropriate technologies can not only greatly simplify your life but also enhance your professional image in the eyes of your clientele.

Find the Best Possible Price

As a property management company, this is likely one of the most significant decisions you will have to make. The outcome will impact how well you draw in or turn away potential customers. Basically, the basic rule of thumb is to always make an informed selection after researching what your competitors are charging in the area. By doing so, you’ll be able to strike a nice balance between being the most costly and the lowest player in the market.

Just give them a call and act as though you need their assistance; they will provide you with all the information you could ever want. Additionally, have a peep at their management agreements and brochures; this will help you create your own.

Control Your Cash Outflow

Maintaining a steady flow of revenue is essential to your commercial business’s success. In order to accomplish this, you must be aware of any potential gaps in your assets, both literal and otherwise, and fill them in as needed.

A building with a leaky roof, for instance, is also viewed as a major liability risk because of the possible legal issues it may pose if left unfixed. Other examples of properties that are considered money drains include those that do not pay for themselves, meaning the rent is insufficient to cover all of the expenses.

Furthermore, start carefully and scale as you go with your recruitment rather than becoming overly enthusiastic at first. About thirty apartments can be managed by one property manager. Hire some more workers once you cross this barrier, and so forth.

If necessary, make a functioning budget to ensure that your bottom line is constantly positive.

Promote Yourself

You have to start promoting yourself if you want to start getting clients. Make an internet presence your first step. To draw clients to your brand, pick a few standout colors and a complementary logo. Don’t forget to use these elements on your business cards. Once that’s done, you can get things going with some low-cost options like content marketing and social media marketing.

However, you must use some word-of-mouth marketing if you want to spread the word effectively. Basically, running referral programs is the best method to accomplish it; they are somewhat expensive but well worth the work.

Network with other individuals and agents in your sector and create a website that serves as the focal point of your commercial property management company. In this manner, you’ll remain knowledgeable and aware of any emerging market trends.